“Investor report and newsletter for the third quarter of 2021”

- Nov 10, 2021

- 5 min read

Updated: Jan 31, 2023

It certainly was a challenging quarter, with numerous headlines impacting economies and markets around the world. Key features include the global roll out of COVID-19 vaccinations, Chinese regulatory announcements, global supply chain disruptions, the potential of a surge in inflation and closer to home, the disturbing unrest in July.

COVID related news has improved materially around the globe. Increasing vaccinations have resulted in more freedom of movement and economic activity returning is to pre-pandemic levels. Borders are opening and the return of the travel industry is a very welcome development.

The Chinese authorities announced, largely unexpected, regulatory controls to combat anti-competitive behaviour with a keen emphasis on social ills perpetrated by the tech giants. These steps have been taken to achieve the stated social objective of reducing inequality. Consequently, this has resulted in a slowdown of economic activity. Key areas include energy shortages, financial distress in the property sector and select tech business strategies being challenged or prevented. This slowdown has had an adverse knock-on impact of commodity prices and which in turn will create challenges for the South African mining sector.

The pandemic has highlighted the reliance on China as a provider of crucial goods to many countries. Add geopolitical tensions, long-term production strategies are likely to be more geographically spread.

The asynchronous national recoveries are causing a mismatch between demand and supply, as well as incompatibilities of jobs and skills shortages, having resulted in major disruptions in global supply chains. This may take some time to ease, while the immediate impact of stock shortages and increasing cost pressures which will lead to inflation.

The recovery in the global economy has been accompanied by a surge in inflation. Some of this can be explained by the base effects from resurgence of activity from the low levels of last year as well as the increase in commodity prices. The debate is whether inflation will moderate or remain structurally higher. This has important consequences for the extent of interest rate hikes both globally and here in South Africa. We can safely conclude that the strong support enjoyed by monetary policy has ended and that the next move in rates will be higher. The issue is how much and when, which remains uncertain at this stage.

The global economy is growing ahead of trend and while we believe it may continue for some time, the pace will slow after this initial rebound from 2020. Domestic economic activity did face a setback with the unrest in July but does appear to be back on track. More recently aided by the potential recovery in tourism and relaxation of social restrictions.

Maintaining a clear focus and strategy remains crucial, especially during times of uncertainty and volatility.

The markets over past quarter

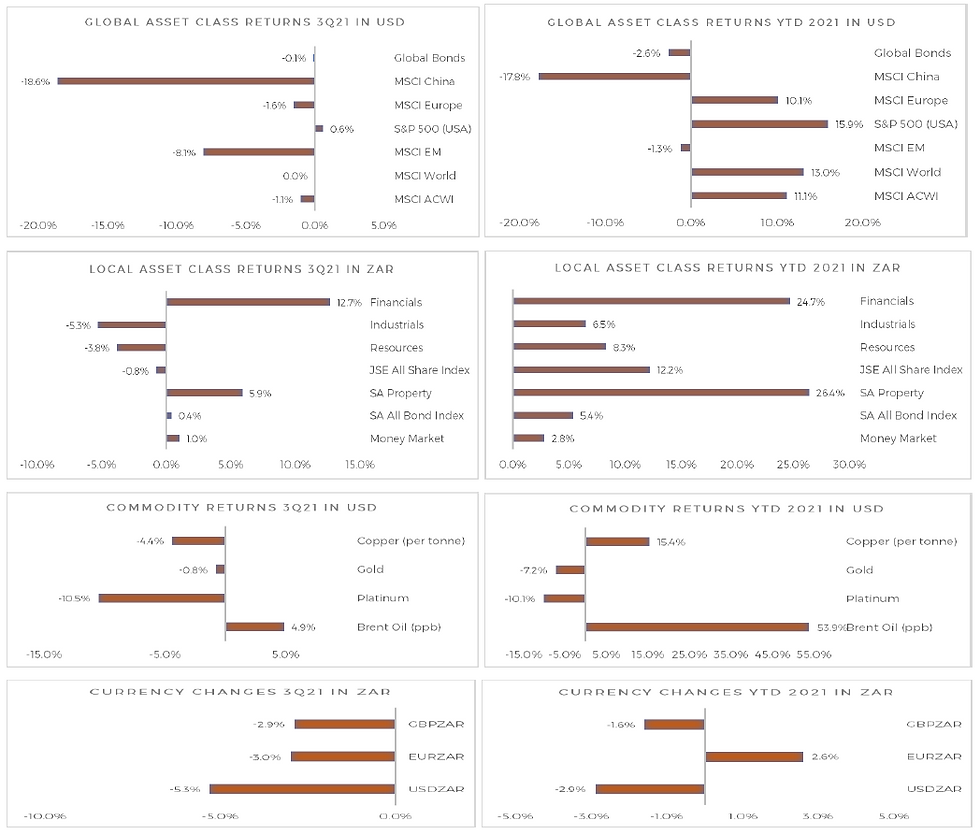

It was a difficult quarter for global equity markets, down 1.5%, with emerging markets particularly weak, down 8%. This rather volatile period was kick-started by the tightening of Chinese regulatory measures, in select economic sectors. It was then followed by headlines of the embattled Evergrande Real Estate Group, which is China’s second largest property developer, highlighting some impending loan defaults and obviously some panicked speculation of a cascade of negative knock-on effects for the whole Chinese economy. Concerns are that global economic growth could moderate more than expected, plus a reduction in global policy stimulus is now in sight. Added to this, are the prospects of rate hikes in the next year or so which further impacted on overall market sentiment.

The local equity market was largely flat again this quarter. As mentioned, the environment during the period was clearly challenging and this return belies the volatility of underlying sector performance. The resources sector was down some 4% and the industrial sector down over 5%, feeling the economic growth concerns and the China ‘effect’. The financial sector performing strongly, up nearly 13% with property up 6%. For the year so far, the return is 12%.

The performance of commodities reflects the global economic challenges more accurately for both the quarter and the year to date, as copper and platinum struggled while oil recovered from the extremely low levels of 2020.

The local currency was generally weaker for the quarter, while the year to date (YTD) performance is mixed when viewed against the US dollar, the Euro and the British Pound. For the past twelve months it is worth remembering the strength of the rand, from USD/ZAR 16.58

in September 2020 to USD/ZAR 14.65 in September 2021.

The charts below highlight the performance of selected markets and asset classes for the past quarter as well as the year to date. Returns have been varied and extreme, mirroring the economic challenges being faced as well as with the uncertainly in China being felt in emerging markets and commodity prices.

Source: MSCI, Datastream, Morgan Stanley Research, Bloomberg and Visio

Valuations and opportunities

Global valuations in certain major markets such as the USA are tending to be more fully priced and may contribute to further market volatility. Conversely, in non-US markets, the relative discount in ratings when compared to the USA, is trading at historically low levels – as shown in the chart below. In China, we think investor perceptions and economic reality are bringing opportunities, with valuations becoming attractive.

Source: Thomson Reuters, IBES, RMB Morgan Stanley, data as at 30 September 2021

It is interesting to note that the local equity market is trading at valuation levels below those seen in March of 2020. This is largely explained by the valuations of the resources sector. This may beg the question as to how much of investor concerns that we have stated are already priced in. The financial and industrial sectors are still trading at their fair values.

Our long-term bias in the portfolio allocation of our clients is to equities where relevant. Over time, equities outperform most investable asset classes available and more importantly provide real growth in the long-term. This holds true both locally and globally. During periods of expected recession, this changes and markets will fall. In time, this provides an opportunity to re-invest. In the current stimulatory global growth environment with low prospects of a recession, equities remain our asset class of choice.

Within our equity selection, we focus on the underlying long-term fundamentals of each investment that we make to determine the return outcome, irrespective of the macro conditions.

We reaffirm that each component in your portfolio construction is working to ensure the risk and return characteristics of your assets are optimal, irrespective of the market conditions. We are pleased to note that returns in these extremely volatile times have remained robust, with volatility kept to a minimum.

Thank you for your interest and ongoing support.

We welcome any feedback or questions.

Kind regards

Oliver, Ulf, Vanessa and Warren

Comments