Cynical Markets

- Apr 1, 2022

- 3 min read

Global markets have been particularly volatile of late, with sharp intraday price movements resulting in extended deviations between market and intrinsic values. Oscar Wilde famously described a cynic as someone who “knows the price of everything and the value of nothing”. Global markets have displayed a degree of cynicism of late with their ability to continuously trade at prices which differ significantly from their intrinsic value. The below article provides some insight into market and intrinsic values and why we are confident in the holdings within our funds.

Intrinsic vs Market Value

The term “market value” simply refers to the current market price of a security, whereas intrinsic value represents the true economic value of a company. Intrinsic value is also known as “fair market value” or simply “fair value.”

Intrinsic value is a measure of what an asset is worth. This measure is arrived at by means of an objective calculation or complex financial model, rather than using the current trading market price of that asset.

There is no universal standard for calculating the intrinsic value of a company and valuation models are based on aspects of a business that include qualitative, quantitative and perceptual factors. Qualitative factors such as business model, governance, and target markets are those items specific to the what the business does. Quantitative factors found in fundamental analysis include financial ratios and financial statement analysis. These factors refer to the measures of how well the business performs. Perceptual factors seek to capture investors perceptions of the relative worth of an asset.

Market value tends to be influenced by public sentiment and macroeconomic factors. Fear and greed are the primary emotions that drive markets. During a stock market crash, for example, fear may grip investors and the market value of many stocks could fall well below their fair market values. News headlines can drive stock prices above or below their intrinsic value. After reading an earnings report that’s negative, investors may aggressively sell a stock. Even though worse-than-expected earnings might decrease the intrinsic value of a stock to a certain degree, investors can be fearful in the short-term and create overextended losses in the stock price.

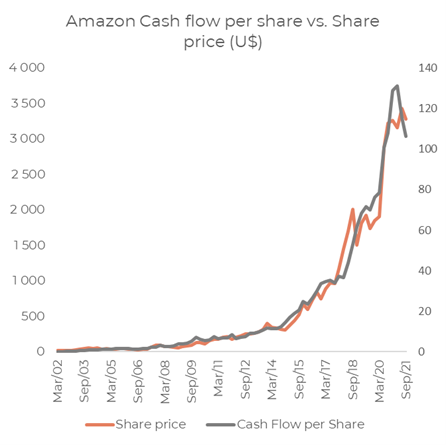

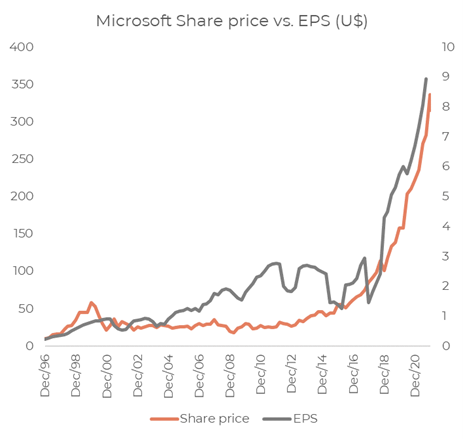

In the presence of perfect capital markets, market and intrinsic value should be equal. However there are numerous factors, some of which have been highlighted above, that could result in a significant deviation between the two. Using two holdings within the Global Equity Fund as examples, the graphs below illustrate how share prices tend to track the underlying fundamentals of a company and highlights how deviations between the two can persist for extended periods of time.

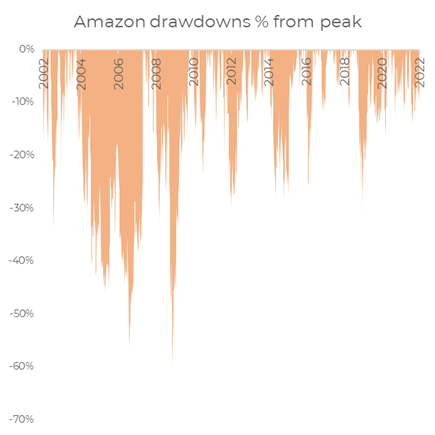

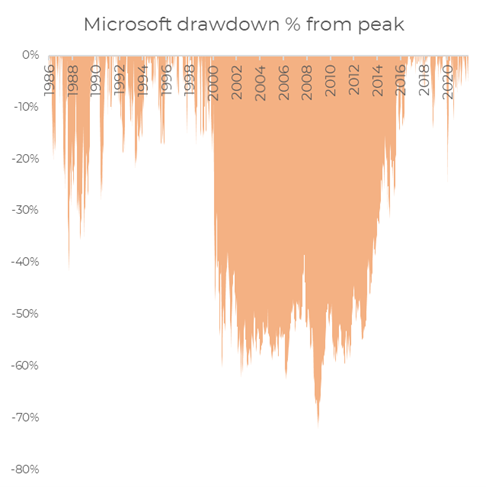

Over the long-term market and intrinsic value should converge, however in the short-term there a numerous exogenous variables that influence a company’s market value outside of the company’s control. The below graphs illustrate the frequency and severity of the drawdowns in Amazon’s and Microsoft’s share prices respectively, despite the fundamentals of these companies remaining robust over the same measurement period.

Focusing on Fundamentals

As illustrated above, share prices rarely reflect true economic value and as per Oscar Wilde’s description can remain cynical for extended periods of time. Therefore, a focus on a company’s fundamentals is crucial to ensuring long term investment success, as these variables ultimately drive long term returns.

Therefore, at Baymont Wealth an emphasis is placed on ensuring the strength of the fundamentals of holdings in clients’ portfolios. The table below outlines the exemplarily characteristics of the Global Equity Fund over the past three years with –

1. High revenue growth;

2. Strong profitability (as indicated by the high gross and operating margins);

3. Good return on invested capital (as indicated by Cash Flow Return on Invested Capital and Return on Invested Capital); and

4. Strong ability to cover liabilities (as indicated by the low Net Debt/EBITDA ratios).

Source: Factset.

Investment success is largely dependent upon the ability to remain patient during times of turbulence. This is achieved by focusing on a company’s fundamentals rather than intraday market price movements. Benjamin Graham, often referred to as the father of value investing, said “Invest only if you would be comfortable owning a stock even if you had no way of knowing its daily share price” and an investment philosophy abiding by this would safeguard against cynical markets.

- Matthew Scruton

Comments